This document has been compiled using indicators provided by the Market-Signals trading bot which studies global market data. This document shows the evolution of the strategies proposed by the bot and gives the trends of a selection of ETFs, which follow the main world markets, for November 2022. The strategies hold only long positions. No leverage is used. This document is for information purposes only and should not be taken as investment advice.

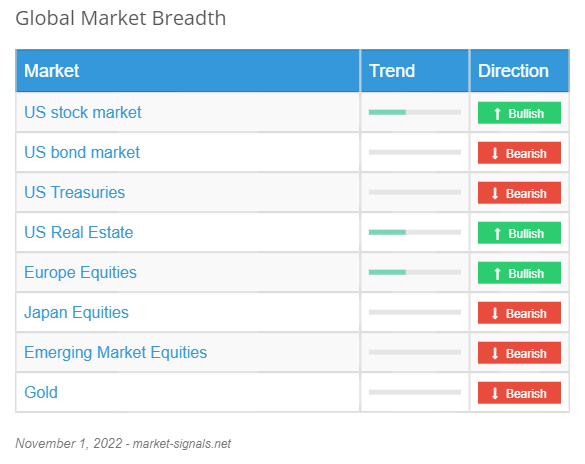

Global Market Breadth

| Market | Trend | Direction |

|---|---|---|

| US stock market |

|

|

| US bond market |

|

|

| US Treasuries |

|

|

| US Real Estate |

|

|

| Europe Equities |

|

|

| Japan Equities |

|

|

| Emerging Market Equities |

|

|

| Gold |

|

Portfolios

US Growth Portfolio

T

he portfolio US Growth fell 0.33% in October. We find a positive trend in the U.S. equity market however the trend in US stocks ETFs is uncertain, so the portfolio is allocated to a long-term U.S. Treasury Bond ETF (TLT). The degree of risk of the strategy for November is low with a Risk Score unchanged of 0 out of 10.

The 1-year performance of this portfolio is -14.10%. Since opening the portfolio at eToro in November 2019, the strategy has performed 66.28%, in comparison, the benchmark asset (S&P 500) has advanced 33.57%. The strategy has suffered a maximum loss of 16.74% since the portfolio opened at eToro, compared to the benchmark asset (S&P 500) which lost 23.91% at maximum.

This strategy captures the U.S. stock market growth for long-term investors who want high returns.

Since inception at eToro

Max drawdown

Since inception at eToro

Portfolio: -16.74%

S&P 500: -23.91%

- eToro portfolio

US Balanced Portfolio

T

he portfolio US Balanced remained steady in October. The strategy combines an allocation in US bonds (30%) with the US Growth portfolio (70%). The trend in the US bond market for November is negative. The Exchange Traded Fund selected in the bond part for this month is IEF. The Exchange Traded Fund that makes up the portfolio does not change in November. The portfolio's allocation is 100% cash. The degree of risk of the strategy for November is low with a Risk Score steady of 0 out of 10.

The 1-year performance of this strategy is -8.99%.

This strategy provides a balanced stocks and bonds allocation for investors who want a U.S. market exposure with limited risks.

Global Conservative Portfolio

T

he portfolio Global Conservative stayed constant in October. The Strategy combines a multi-market protective asset allocation strategy (Global Stable portfolio 70%) and a US stock market strategy (US Growth portfolio 30%). The ETF that makes up the portfolio does not change in November. The portfolio's allocation is 100% cash. The level of risk of the strategy for November is low with a Risk Score steady of 0 out of 10.

The 1-year change of this strategy is -7.36%.

This strategy provides a broad geographic diversification for investors who want an international exposure.

Global Stable Portfolio

T

he portfolio Global Stable remained steady in October. The overall market trend for November is negative. By analyzing a diverse multi-market composed of 12 Trackers (stocks, bonds, gold, real estate, international and emerging markets...), we observe that 0 assets only show a positive evolution. Our model allocates 0% to Risk-On assets and 100% to Risk-Off assets. The ETF that makes up the portfolio does not change in November. The portfolio's allocation is 100% cash. The degree of risk of the strategy for November is low with a Risk Score stable of 0 out of 10.

The 1-year change of this strategy is -5.66%.

This is the safest strategy, the one with the lowest volatility and the least max drawdown of the 4 offered, that makes this strategy an alternative to a 1-Year Term Deposit.

ETF Trends

VNQ Vanguard Real Estate ETF

- US Real Estate

The VNQ ETF, which replicates the broad U.S. real estate market, rebounds promptly by 3.51% in October. The evolution of the performance of this ETF over 1 year is -24.77%. A trend reversal has been identified in November with a Trend Score of 4 out of 10. The degree of risk of this ETF in November is high with a Risk Score in regression of 7 out of 10.

QQQ Invesco QQQ

- Nasdaq 100

The QQQ ETF, which follows large-cap US technology companies, rebounds sharply by 4% in October. The performance over a period of 1 year of this equity is -28.24%. A trend reversal has been detected in November with a Trend Score of 4 out of 10. The level of risk of this equity in November is high with a Risk Score unchanged of 7 out of 10.

EFA iShares MSCI EAFE ETF

- Europe, Australia and Far East Equities

The EFA ETF, which replicates an index composed of companies from Europe, Australia and the Far East, rebounds sharply by 5.89% last month. The evolution of the performance of this ETF over 1 year is -26.25%. A trend reversal has been identified in November with a Trend Score of 4 out of 10. The degree of risk of this ETF in November is high with a Risk Score in regression of 7 out of 10.

SPY SPDR S&P 500 ETF

- S&P 500

The SPY ETF, which replicates large-cap U.S. stocks, rebounds sharply by 8.13% in October. The performance over a period of 1 year of this ETF is -15.90%. A trend reversal has been detected in November with a Trend Score of 4 out of 10. The degree of risk of this ETF in November is high with a Risk Score in regression of 7 out of 10.

VGK Vanguard FTSE Europe ETF

- Europe Equities

The VGK Exchange-Traded Fund from Vanguard, which tracks companies located in major European markets, rebounds promptly by 8.43% in October. The evolution of the performance of this Exchange-Traded Fund over 1 year is -26.47%. A trend reversal has been detected in November with a Trend Score of 4 out of 10. The degree of risk of this Exchange-Traded Fund in November is high with a Risk Score in regression of 7 out of 10.

IWM iShares Russell 2000 ETF

- US Small Cap Equities

The IWM ETF, which tracks an index composed of small-capitalization U.S. equities, rebounds promptly by 11.16% in October. The evolution of the performance of this equity over 1 year is -19.74%. A trend reversal has been detected in November with a Trend Score of 4 out of 10. The degree of risk of this equity in November is high with a Risk Score stable of 7 out of 10.

MDY SPDR S&P Midcap 400

- Midcap 400

The MDY ETF, which measures the S&P MidCap 400 Index, rebounds promptly by 10.48% in October. The evolution of the performance of this ETF over 1 year is -12.97%. A trend reversal has been detected in November with a Trend Score of 4 out of 10. The level of risk of this ETF in November is high with a Risk Score in decline of 7 out of 10.

TLT iShares 20+ Year Treasury Bond ETF

- Long-Term US Treasuries

The TLT ETF, which mimics long-Term US Treasuries, decreases sharply by 6.19% last month. The 1 year trailing return of this ETF is -34.69%. The trend in this month is bearish. The degree of risk of this ETF in November is high with a Risk Score in progression of 7 out of 10. This ETF is invested in the strategy US Growth in November.

EEM iShares MSCI Emerging Markets ETF

- Emerging Market Equities

The EEM ETF, which replicates an index composed of companies from emerging markets, decreased 1.98% in October. The evolution of the performance of this equity over 1 year is -32%. The trend in November is negative. The degree of risk of this equity in November is medium with a Risk Score in regression of 4 out of 10.

LQD iShares iBoxx $ Investment Grade Corporate Bond

- US Corporate Bonds

The LQD Exchange-Traded Fund from iShares, which mimics a broad range of U.S. investment grade corporate bonds, dropped 1.07% in October. The performance over a period of 1 year of this ETF is -24.06%. The trend in November is negative. The degree of risk of this ETF in this month is medium with a Risk Score in regression of 5 out of 10.

EWJ iShares MSCI JAPAN ETF

- Japan Equities

The EWJ ETF, which monitors the Japan Equities index, bounced back 2.33% in October. The evolution of the performance of this ETF over 1 year is -27.94%. The trend in November is bearish. The level of risk of this ETF in November is low with a Risk Score in decline of 3 out of 10.

IEF iShares 7-10 Year Treasury Bond ETF

- Intermediate-term US Treasuries

The IEF ETF, which tracks intermediate-term U.S. Treasury bonds, retreated 1.65% last month. The 1 year trailing return of this ETF is -17.54%. The trend in this month is negative. The degree of risk of this ETF in this month is medium with a Risk Score in regression of 6 out of 10.

GLD SPDR Gold

- Gold

The GLD Exchange-Traded Fund from SPDR, which monitors gold, dropped 1.78% in October. The evolution of the performance of this ETF over 1 year is -9.04%. The trend in this month is bearish. The degree of risk of this ETF in this month is medium with a Risk Score unchanged of 4 out of 10.

BND Vanguard Total Bond Market ETF

- US Total Bond Market

The BND ETF, which measures a broad, US market-weighted bond index, decreased 1.37% last month. The 1 year trailing return of this ETF is -17.65%. The trend in this month is bearish. The level of risk of this ETF in this month is medium with a Risk Score in decline of 6 out of 10.

JNK SPDR Bloomberg High Yield Bond

- High Yield Bonds

The JNK ETF, which tracks US "junk" bonds, shifted upwards 2.50% last month. The evolution of the performance of this ETF over 1 year is -16.67%. The trend in this month is bearish. The degree of risk of this ETF in this month is medium with a Risk Score in regression of 4 out of 10.

Compliance disclaimer

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation,

or an offer of, or solicitation to buy or sell, any financial instruments.

Natevia makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication,

which has been prepared utilizing publicly-available information.

Past Performance is not indicative of future results.