Autopilot ETF Trading Bots

The trading bot strategies combine Trend Following and Assets Allocation models to take positions in ETFs

What is an Autopilot

ETF Trading Bot?

An ETF Trading bot is a software that analyzes market data and makes automatically ETF (Exchange-traded funds) buy/sell operations based on indicators built with these data.

Our Trading bot strategies combine Trend Following and Assets Allocation models to take positions in ETFs.

These trading bots give you access to techniques normally available in Hedge Funds.

Reduce risk

All 4 strategies are ETF trading strategies, by their very nature (baskets of assets), reduce a good portion of the risk and volatility inherent in owning individual securities.

The strategies include a flight-to-safety trigger that moves the portfolio to Risk-Off assets (Treasury Bond ETF) in the event of a market crash.

Keep it simple

Our Trading bot strategies are available on the eToro social trading platform. eToro has pioneered the concept of Copy Trading, which enables you to automatically copy strategies of your choosing.

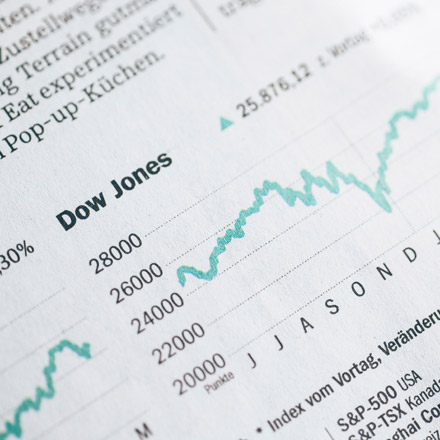

Attractive returns

The 5-year trailing return for the S&P 500 is +96%. More and more studies have shown that it is excessively hard to beat the market (more than 90% of the actively managed equity funds in the US underperformed the S&P 500)

The backtested 5-year trailing return for the US Growth trading bot strategy is +80%.

Copy Trading

How does it work?

Done in just 4 easy steps

-

1

Sign up for eToro

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

-

2

Choose a strategy

-

3

Set an amount

Decide on the amount you want to allocate out of the total equity in your account

-

4

Click COPY

Click the “Copy” button to start automatically copying the strategy’s positions

Latest Posts

Is the SPDR S&P 500 ETF trust the smartest investment today?

Are you looking for a simple and effective way to invest in the stock market? Maybe you've heard about the SPDR S&P 500 ETF Trust ...

Best stocks in the world? this ETF is crushing the S&P 500 in 2025

Are you looking for a way to boost your portfolio and outperform the market? The start of 2025 has been rocky, but one specific investment vehicle is ...

Leaving your Bitcoin behind: a tricky inheritance

Did you know that inheriting Bitcoin can be far more complicated than inheriting a bank account? Many crypto firms don't have straightforward processes for passing on your digital ...

Trading bots vs AI agents: the future of automated trading

The world of cryptocurrency trading is evolving rapidly. Automated trading is becoming increasingly popular. But which is better: trading bots or AI agents? Let's find out. Trading bots ...

Opportunity clues in trend-following ETFs

Are you ready to unlock the secrets of successful investing? Trend-following ETFs could be your key. These funds offer a unique approach to the market, capitalizing on consistent ...

Capitalize on the Rising Demand for Cybersecurity with eToro's CyberSecurity Smart Portfolio

Have you been hearing a lot about the importance of cybersecurity lately? It seems like every day there are new headlines about major hacks and data breaches affecting companies, ...

Capitalize on Financial Innovation with eToro's Fin-Tech Smart Portfolio

Hey there, investor! Are you excited about the mind-blowing changes happening in the world of finance? Mobile apps replacing traditional banks, cryptocurrencies challenging fiat money, and blockchain revolutionizing how ...

eToro's AI-Revolution Portfolio: Diversified Exposure to the AI Megatrend

eToro's AI-Revolution is an innovative investment product that provides diversified exposure to the exciting world of artificial intelligence. This "smart portfolio" contains a curated basket of stocks of companies ...